A suspense account is used when the right account cannot be determined on the time the transaction is recorded. When the proper account is set, the quantity will be moved from the suspense account to the proper account. It can also be used when there’s a distinction between the debit and credit score side of a closing or trial balance, as a holding space till the rationale for error is located and corrected. As An Alternative of this causing confusion or potential errors in your account, the funds are positioned right into a brokerage suspense account. This ensures that your money is safely held whereas any uncertainties are resolved.

A suspense account is important as a end result of it permits businesses to maintain correct monetary records without holding up the complete accounting process. Instead of leaving transactions unrecorded or delaying financial reporting, the suspense account provides a way to temporarily store unclear or incomplete transactions. This helps be sure that the enterprise can proceed with its accounting and operations while resolving any issues with the transaction. Suspense Accounts are essential instruments in accounting, offering a temporary holding place for unidentified, incomplete, or erroneous transactions. Proper accounting entries be certain that the books remain balanced whereas discrepancies are investigated and resolved.

Highradius Named As A Serious Player For Treasury & Risk Management Software Program By Idc

No, in contrast to mortgage escrow accounts, the money in a mortgage suspense account doesn’t earn any interest for the borrower. A common ledger is the place a business records its belongings and liabilities on an ongoing basis, broken into separate classes or accounts. Suspense accounts are used for assets or liabilities that require additional clarification before they are often assigned a everlasting place in the ledger. The rules that mortgage servicers must follow are spelled out by the Client Monetary Protection Bureau, which enforces the federal Actual Estate Settlement Procedures Act.

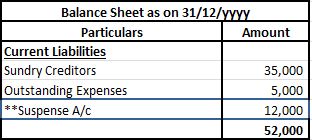

What Is A Suspense Account In Steadiness Sheet?

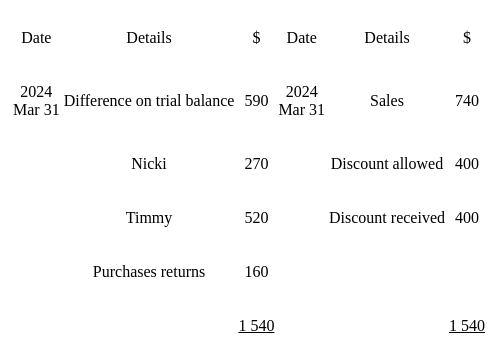

When the whole of the debit column in a Trial Steadiness does not equal the whole of the credit column, the distinction is positioned in a Suspense Account to make them agree briefly. For instance, if the debit facet is short by ₹500, the Suspense Account is debited with ₹500 to steadiness the Trial Stability. This step is a practical measure that facilitates the well timed preparation of the Revenue Statement and Stability Sheet, stopping delays caused by the seek for one-sided errors. When a suspense record is entered through the Suspense screen it is initially given a status of Open, which means the full amount has not been hooked up to a coverage or insurance policies. Once the complete suspense report quantity is hooked up to one or more policies, the suspense document’s standing is routinely modified to Closed and no more cash could additionally be attached to the record. As lengthy because the connected quantity is lower than the suspense record amount, the standing will remain Open.

A suspense account is an account in the basic ledger used to temporarily retailer transactions that require further analysis and rechecking earlier than a permanent model could be made within the report books. It Is an account the place you can also make ambiguous entries till you find the place those funds came from or obtain full cost from a shopper. Suspense accounts allow businesses to construction their approach to different transactions. By using suspense accounts successfully, agencies can preserve the integrity of their monetary data and improve their general effectivity.

A suspense account is a element of a company’s monetary accounts that’s used to report confusing entries that require further examination to determine their proper classification. Relying CARES Act on the context, “suspense account” would possibly imply a quantity of different things. In simple terms, a suspense account is a bookkeeping account whereby transactions are recorded before being assigned to the best class.

A Suspense Account is a quick lived account within the common ledger used to report unclassified transactions or discrepancies. A suspense stability mortgage refers to a temporary account where incomplete or unclear mortgage payments are held. If funds don’t cover all dues or lack allocation particulars, they are positioned in suspense till resolved. This ensures funds are utilized accurately, preventing potential servicing errors.

- As Soon As the required details can be found, the quantities within the suspense account are transferred to their applicable accounts.

- A trial steadiness is the closing steadiness of an account that we calculate at the finish of the accounting period.

- The suspense account will be listed underneath “Other Assets” in your trial stability sheet.

- While suspense accounts are invaluable tools in accounting for managing transactions that cannot be instantly categorized, in addition they include their own set of challenges.

- Suspense accounts are a type of short-term holding account used to maintain monitor of earnings and outlays that haven’t been allotted to a specific use.

- A suspense account is a short lived account the place entries with discrepancies and doubtful elements are parked.

They track unapplied money receipts and payments, which helps identify probably fraudulent exercise https://www.simple-accounting.org/. These accounts provide momentary storage for transactions that require further investigation or clarification. However generally, if the payment isn’t enough to cowl all dues, or if there’s confusion about the cost amount,, the cash might go right into a mortgage suspense account. Eventually, you allocate entries in the suspense account to a everlasting account.

Use a suspense account whenever you buy a hard and fast asset on a cost plan however do not obtain it until you totally pay it off. After you make the final payment and obtain the item, shut the suspense account and open a separate asset account. Lenders and loan servicers may discuss with suspense accounts as “unapplied funds accounts.” Simply upload your form 16, claim your deductions and get your acknowledgment quantity on-line. You can efile income tax return in your revenue from salary, home property, capital features, business & profession and income from different sources. Additional you might also file TDS returns, generate Form-16, use our Tax Calculator software program, declare HRA, examine refund standing and generate hire receipts for Earnings Tax Filing.

It ensures the balance sheet remains correct whereas particulars are clarified or changes are made. Partial funds that don’t settle an invoice in full are positioned in a suspense account until clarification is obtained. Think About JKL Enterprises obtained a partial fee of $300 on a $1,000 invoice. The payment did not specify which bill it was intended for, so it was briefly held in a suspense account.